My advice • May 09, 2024

Laddering your investments is a winning strategy

Discover the many benefits of laddering

When it comes to investing, the idea of tying up money for a long period of time can deter many people. That’s where a laddering strategy becomes very useful. But what exactly is laddering, and more importantly, does this strategy work with your financial goals? Here’s everything you need to know about it.

What’s involved with laddering your investments?

When you decide to invest in financial products like Guaranteed Investment Certificates (GICs), you’re committing your money for a fixed term. That means you won’t be able to access your funds until they mature.

Let’s say you want to invest

Why ladder your investments?

Laddering not only gives you access to your money at different maturity dates, but it has a number of other advantages, too.

Diversify your investments

It’s always a good idea to diversify, regardless of your risk tolerance level. In addition to laddering the maturity dates of your investments, you can also diversify the types of financial products you’re investing in.

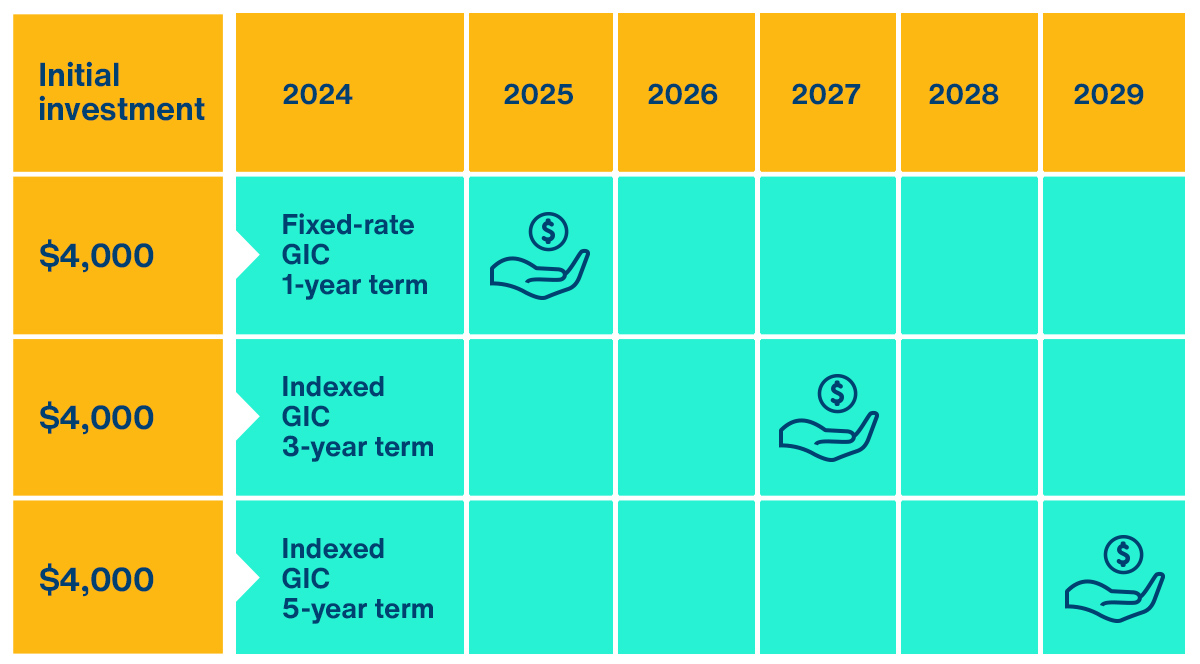

Let’s go back to the example where you want to invest

Reduce risk

Investing in products such as indexed GICs means your funds are susceptible to market fluctuations.

By laddering your investments across different maturity dates, you can minimize the impact of these fluctuations. This strategy will also ensure you have regular access to your funds.

For example, if the stock market underperforms just before one of your indexed GICs matures, you may earn a smaller return at the end of the term. On the other hand, if you have diversified your investments across various maturity dates, your other investments could potentially yield higher returns, offsetting the weaker performing investment.

Lower your tax bill

Interest generated by investment products in non-registered accounts is considered interest income. Staggering returns over several years will prevent your taxable income from increasing drastically in one year.

Bring a project to life

As your funds are locked in until maturity, laddering can be a great way to access the money you need to complete those important projects, whether you want to spruce up your yard when summer arrives or make a prepayment on your mortgage to pay down your house faster.

About indexed GICs

ActionGICs, more commonly known as indexed GICs, are designed for investors who want the potential for high returns as well as security. With an indexed GIC, you generate market-linked returns while your principal is guaranteed. Some ActionGICs even offer a minimum guaranteed return.

Even though GICs are rarely impacted, you should still be prepared to assume the risks of the stock market. It’s possible that the final return on your indexed GIC will be nothing more than the guaranteed minimum return—or no return at all if you chose an indexed GIC that doesn’t offer a guaranteed minimum return.

Still unsure about investing in an ActionGIC? Nothing’s stopping you from investing a small amount and watching it grow! Past returns can also give you an idea how GICs evolved over time, but keep in mind that past performance doesn’t guarantee future returns. Review ActionGIC performance, current issues on sale and past issues.

It’s also good to know that market-linked GICs are eligible for deposit insurance from the Canada Deposit Insurance Corporation (CDIC).2 For details, read the CDIC abbreviated brochure available in branches or visit cdic.ca.

Ready to take the next step?

Book a meeting with a Laurentian Bank advisor. No matter what you’re saving for, you’ll benefit from customized advice. And together, you’ll build a personalized investment strategy that fits your profile and goals.

+ Legal Notices

- GICs are not cashable. Simple interest is paid on terms of less than two years. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and compounded annually, and paid at maturity. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank of Canada investment product are not eligible for this offer. This product is eligible for registered and non-registered plans. Laurentian Bank of Canada is a member of the Canada Deposit Insurance Corporation (CDIC).This product is eligible for deposit insurance from the Canadian Deposit Insurance Corporation (CDIC), up to the maximum limit for coverage from the CDIC, and subject to applicable conditions. For more information, call 1-844-494-0076 or contact your advisor.

- A return may be nil at maturity unless it is subject to a guaranteed minimum rate of return. A minimum or maximum rate of return is determined and disclosed to you prior to the issuance. Your actual rate of return is contingent upon the performance of the reference index. As applicable, the rate of return is non-compounding over the term of the ActionGIC and calculated solely on the initial investment, which along with the applicable rate of return, is paid at maturity. The minimum and maximum rate of return may vary between issuances. The posted rate corresponds to the maximum rate and minimum rate of return. The final rate of return of a Laurentian Bank ActionGIC is calculated based on the performance of the reference index between the issue date and the maturity date of the investment. If applicable, the rate of return is subject to the maximum and minimum rate of return. The value at maturity is obtained by calculating the average value of the index at closing, on the three dates for the calculation of the reference index as specified in the purchase agreement. The final return of the reference index is determined by calculating the sum of the return for each share in the reference index during the period divided by the number of shares making up the reference index. Since the rate of return of this investment depends on the performance of a reference index comprised of securities, any fluctuations in the reference index will affect the investment’s final rate of return and if applicable, will determine if a maximum or minimum rate of return will apply. Past performance is not an indicator of future performance. This investment is eligible for a non-registered or a registered plan such as an RRSP, RRIF or TFSA. A minimum investment of $500 is required. This product is eligible for deposit insurance from the Canadian Deposit Insurance Corporation (CDIC) up to the maximum limit for coverage from the CDIC and subject to applicable conditions. Laurentian Bank of Canada, Laurentian Trust of Canada Inc, LBC Trust are members of the CDIC. The terms and conditions of this product are available at the branch. Laurentian Bank of Canada reserves the right to modify, suspend or withdraw this offer at any time without notice. If applicable, since the ActionGIC is issued on a fixed date following an initial subscription period, any amount received before the issue date of this product will be invested in a short-term GIC (“Pending ActionGIC”) before the final issuance of the ActionGIC. The principal and any interest earned (annual fixed, simple interest, calculated daily) during this period will be automatically added at maturity of the Pending ActionGIC to the investment of the ActionGIC.

Existing investment accounts are offered by Laurentian Bank of Canada (“Laurentian Bank”) or LBC Financial Services Inc. (“LBCFS”). LBCFS is a wholly-owned subsidiary of Laurentian Bank and a separate entity from Laurentian Bank, B2B Trustco and all other issuers or mutual fund companies whose products it distributes. Newly opened investment accounts must be LBCFS accounts. A Laurentian Bank advisor is also a licensed LBCFS mutual fund representative. LBCFS’s liability is limited to the conduct of its representatives in the performance of their duties for LBCFS.

The articles on this website are for information purposes only. They do not create any legal or contractual obligation for Laurentian Bank and its subsidiaries.

These articles do not constitute financial, accounting, legal or tax-related advice and should not be used for such purposes. Laurentian Bank and its subsidiaries may not be held liable for any damage you may incur as part of such use. Please contact your advisor or any other independent professionals, who will advise you as needed.

The articles may contain hyperlinks leading to external sites that are not managed by LBC. LBC cannot be held liable for the content of such external sites or the damage that may result from their use.

Prior written consent from the Laurentian Bank of Canada is required for any reproduction, retransmission, publication or other use, in whole or in part, of the contents of this site.