My advice • February 13, 2020

modified on May 21, 2020

Investment Series - Have any goals? Think about saving on an ongoing basis

See the positive impact of periodic savings on your nest egg

Pierre-Raphaël Comeau

Pierre-Raphaël ComeauExpert Advisor, Wealth Management

and LBC Financial Services Financial

Planner

Just like a bill due on a regular basis–think Hydro, Bell or Videotron–periodic savings are a very good habit to have. Why not pay yourself like you do these companies? There’s a solution: The Periodic Savings Plan. Just like a long journey starts with a single step, achieve your goals (e.g., home, retirement, car, trips, renovations) one payment at a time.

The Periodic Savings Plan makes it easier to save: you set aside money on a regular and automatic basis. These are payments withdrawn directly from your account, rather than a big amount that you set aside every now and then. You set the amount and frequency of your payments, which you can change as you see fit. All without you having to think about it.

Periodic savings vs. a single annual contribution

In addition to its ease and flexibility, efficiency is also a significant benefit. For example, periodically investing in mutual funds reduces the average acquisition cost of your shares relative to an annual contribution. You therefore buy more shares when the prices are down and fewer when the prices are up.

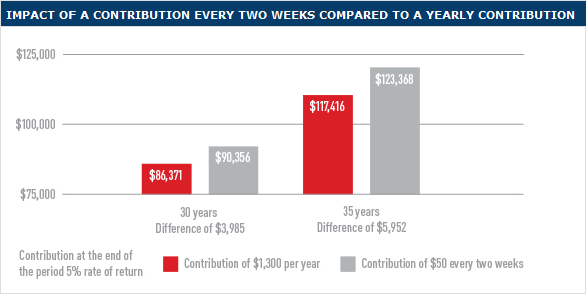

Periodic savings, also known as systematic savings, is a proven way to prepare for retirement. It enables you to build tax-sheltered income on a regular basis. The chart below clearly shows that it is preferable to contribute to your RRSP on a monthly basis rather than once at the end of the year. In this hypothetical case, an investor who started their contributions at 25 would have $5,952 more when they retired at 60. Wind in your sails: Periodic investments in mutual funds accelerate results and make your money work harder for you, bringing you closer to your destination every time.

A hypothetical example based on mutual fund investment.1

Who is this savings solution for?

Periodic savings are for everyone, regardless of the size and scope of your goals, whether they are big or small, short- or long-term. The Periodic Savings Plan includes a Budget Plan, a Security Plan and an Investment Plan that meet various needs. To get started with one of these savings solutions, simply choose a plan and set the amount and frequency of your payments, depending on how much flexibility you have in your budget. This will enable you to save year-round at your own pace. Take the first step today, come and meet your advisor at one of our branches.

A financial health assessment is the first step to better manage your personal finances. It helps paint a clear picture of your financial situation, define and prioritize your objectives, and suggest what you should do. Take your first step now and meet with your advisor.

+ Legal Notices

New investment accounts are offered by LBC Financial Services Inc. (LBCFS). Mutual funds are distributed by LBCFS. The Financial Planning service is offered by LBCFS. LBCFS is a wholly-owned subsidiary of Laurentian Bank and a legal entity distinct from Laurentian Bank and Mackenzie Investments. Mutual funds offered by LBCFS are part of the Laurentian Bank Group of Funds managed by Mackenzie Investments. A Laurentian Bank advisor is also a licensed LBCFS Mutual Fund Representative.

Commissions, trailing commissions, management fees and other expenses all may be associated with mutual fund investments. Nothing guarantees that the fund will maintain its net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. Mutual fund values change frequently, and past performance may not be repeated. Please read the simplified prospectus or Fund Facts before investing in mutual funds.

The articles on this website are for information purposes only. They do not create any legal or contractual obligation for Laurentian Bank and its subsidiaries.

These articles do not constitute financial, accounting, legal or tax-related advice and should not be used for such purposes. Laurentian Bank and its subsidiaries may not be held liable for any damage you may incur as part of such use. Please contact your advisor or any other independent professionals, who will advise you as needed.

The articles may contain hyperlinks leading to external sites that are not managed by LBC. LBC cannot be held liable for the content of such external sites or the damage that may result from their use.

Prior written consent from the Laurentian Bank of Canada is required for any reproduction, retransmission, publication or other use, in whole or in part, of the contents of this site.