My tools • January 28, 2021

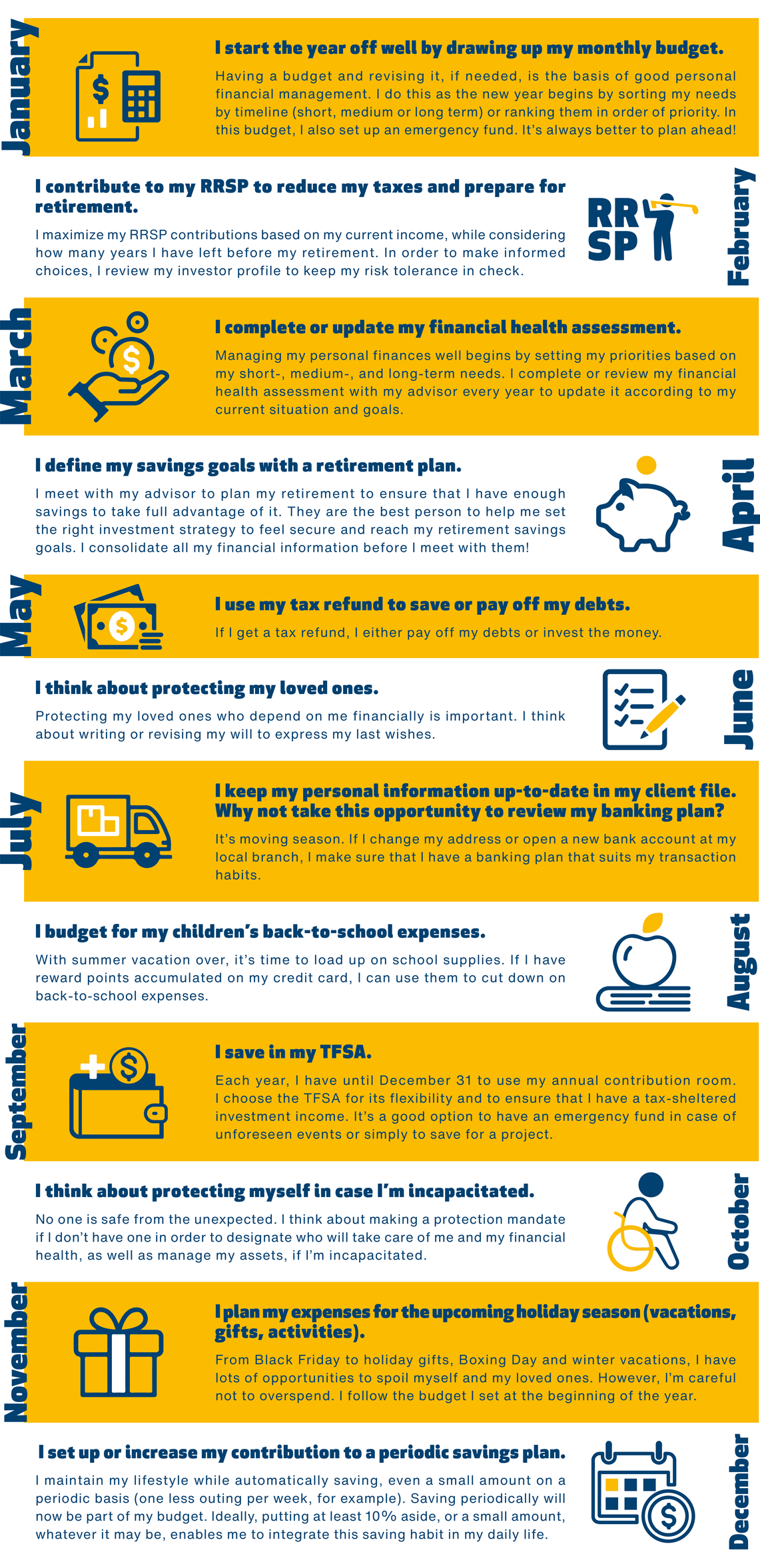

Have you thought about your financial resolutions for 2021?

Here are 12 resolution ideas to keep throughout the year.

Every year, we kick off January with new resolutions. It’s an opportunity to think about positive actions to improve our well-being and quality of life. What if we took a moment to think about our financial health? Here are a few ideas for financial resolutions to adopt over the year to improve your finances.

Keeping your financial resolutions throughout the year will help you better manage your finances. Your Laurentian Bank advisor is available to guide and advise you to help improve your financial health.

+ Legal Notices

New investment accounts are offered by LBC Financial Services Inc. (LBCFS), which is a wholly owned subsidiary and a legal entity distinct from Laurentian Bank and Mackenzie Investments. Mutual funds and the financial planning service are offered by LBCFS. Mutual funds are part of the Laurentian Bank Group of Funds managed by Mackenzie Investments. A Laurentian Bank advisor is also a licensed LBCFS Mutual Fund Representative.

Commissions, trailing commissions, management fees and other expenses all may be associated with mutual fund investments. Nothing guarantees that the fund will maintain its net asset value per unit at a constant amount or that the full amount of your investment in the fund will be returned to you. Mutual fund values change frequently, and past performance may not be repeated. Please read the simplified prospectus or Fund Facts before investing in mutual funds.

The articles on this website are for information purposes only. They do not create any legal or contractual obligation for Laurentian Bank and its subsidiaries.

These articles do not constitute financial, accounting, legal or tax-related advice and should not be used for such purposes. Laurentian Bank and its subsidiaries may not be held liable for any damage you may incur as part of such use. Please contact your advisor or any other independent professionals, who will advise you as needed.

The articles may contain hyperlinks leading to external sites that are not managed by LBC. LBC cannot be held liable for the content of such external sites or the damage that may result from their use.

Prior written consent from the Laurentian Bank of Canada is required for any reproduction, retransmission, publication or other use, in whole or in part, of the contents of this site.