SAVE BETTER TO BRING YOUR PROJECTS TO LIFE.

Laurentian Bank advisors are here to help you get there faster.

PLANNING YOUR NEW LIFE GOES BEYOND NUMBERS.

Get advice from a Laurentian Bank advisor to plan your retirement.

Planning for retirement

A whole new life awaits you after retirement! This new chapter may last over 20 years; therefore, it’s important to plan it carefully to ensure it meets your expectations.

The earlier you plan, the more prepared you’ll be to enjoy the kind of retirement you’ve always dreamed about.

- Why is it important to plan your retirement?

- To approach this new stage of your life with confidence and enthusiasm

- To ensure you can pursue the retirement lifestyle of your dreams

- To focus on your priorities and achieve your long-term financial goals

Some key figures

- The average retirement age is 63.

- The average life expectancy is between 87 and 89, which means many people can expect to spend 25 years or more in retirement.

- Since 2015, the number of people who have reached the age of 100 has increased by 36%.

Retirement can represent a long and beautiful new life. Be prepared to fully enjoy it without having to make any compromises!

+ When should you plan your retirement?

The sooner the better! The earlier you plan, the more prepared you’ll be to take full advantage of this whole new second life.

However, even if you’re only a few years away from retirement, you can still benefit from taking stock of your situation and determining the likelihood of reaching your retirement goals. You still have some wiggle room, which might make all the difference. This is why it’s always wise to establish a retirement plan, no matter how old you are!

+ Are you planning your retirement as a couple?

+ What happens during your meeting with a Laurentian Bank advisor?

- Discuss your plans for a dream retirement and how you are planning to make the transition.

- Help you define your financial objectives in preparation for this new stage of life.

- Identify your sources of retirement income.

- Calculate the amount you’ll need to save to reach your objectives.

- Suggest the most appropriate savings vehicles for your situation.

+ What are the potential sources of income in retirement?

+ How do you see yourself transitioning into retirement and what withdrawal strategy should you have?

There are many ways to prepare for retirement and your transition. Increasingly, instead of stopping work completely, people are choosing a period of semi-retirement, becoming consultants, or even reducing their work hours so that they can focus more on their hobbies or take on small projects.

Your withdrawal strategy, or how to make the most of your savings once retired, is as important as your investment strategy and needs to be established in consultation with your advisor.

The goal of a withdrawal plan is to organize in advance your withdrawal of funds in the most advantageous way so you can maximally benefit from your accumulated savings. This will ensure you have an income that meets your needs throughout the length of your retirement.

Here are a few examples of questions you’ll address when preparing your withdrawal strategy.- When should you start withdrawals from your RRSP? At what pace?

- When is the best time to convert your RRSP to an RRIF?

- Should you hold off on receiving the Quebec Pension Plan and Old Age Security pension?

- What are the advantages of consolidating your assets with the Laurentian Bank?

Your situation may change before the time arrives for your retirement. However, this plan is not definitive, and we recommend you revise it regularly with your advisor to ensure it is always in sync with your goals.

The ABCs of saving

Whether you’re looking to set aside an emergency fund, buy a home, complete a project, or plan for your retirement, here are a few tips to help you reach your objectives.

+ Why is saving important?

Accumulating some savings gives you peace of mind. Thanks to them, in case of unforeseen circumstances, you will be better prepared to deal with the situation.

Savings allow you to achieve short- and medium-term projects, that are important to you, like travelling, buying a house, or retiring.

Finally, saving money can save you more money! It lets you avoid lending fees and can even reduce the amount of income taxes you pay.

+ When is the best time to start saving?

+ How should I start?

- Step 1: Assess your financial health

With the help of an advisor, draw up a complete portrait of your financial situation. This will reveal where you should start and allow you to benefit from personalized advice. - Step 2: Establish a personalized saving strategy

With an advisor, identify your savings goals and their horizons (short, medium, or long term). Then determine the target amount and due date for each goal. - Step 3: Revise your strategy as needed

When an event occurs that is likely to affect your finances (such as retirement, separation, the birth of a child, or health issues), it’s important to adjust your strategy so that it reflects your new situation.

- Read our article Saving for Projects

- Use our calculator to make future savings projections

+ How much to save

Tips to reach your savings goal faster

- Meet with an advisor and take advantage of personalized advice.

- Save regularly by making automatic payments to a dedicated savings account.

- Invest a portion of your additional earnings (such as a work bonus, inheritance, or tax refund).

- Invest your savings so that they will grow instead of leaving them in a regular banking account.

- Use a savings investment vehicle (such as an RRSP or TFSA) so you can benefit from certain tax benefits1 while fully taking advantage of the social programs you qualify for (such as the family allowance or tax credits).

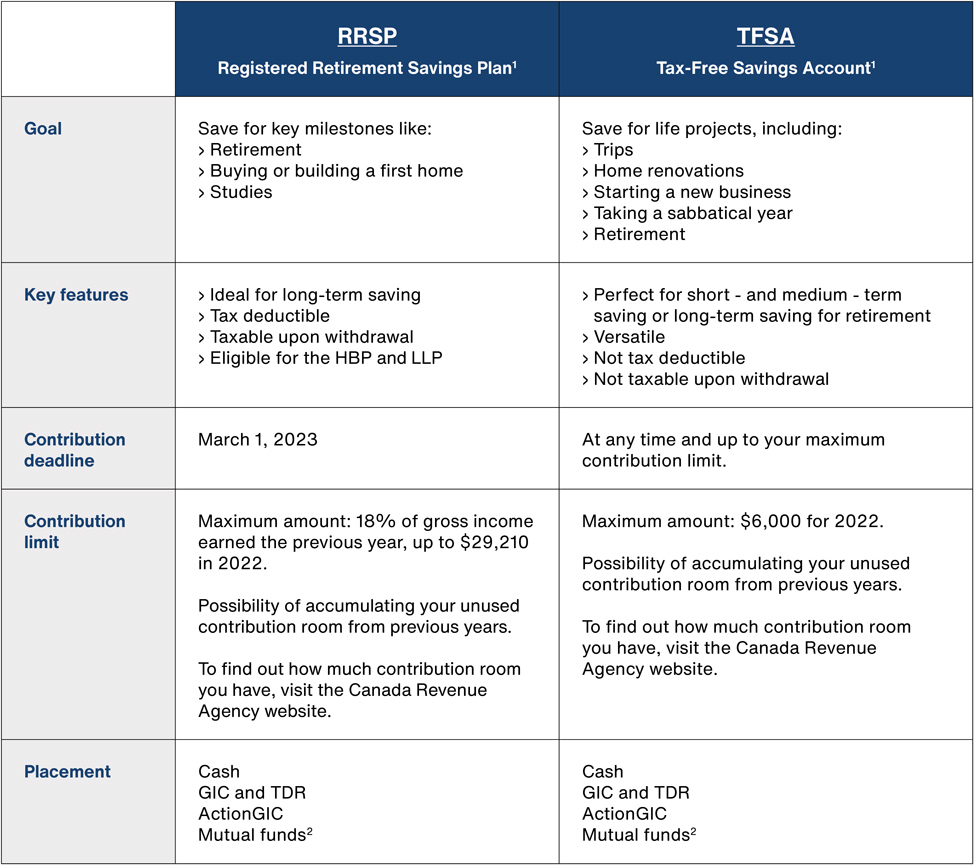

RRSP or TFSA?

How do you decide which is the best option?

The first step is to determine your savings objective!

If you’re looking to save for retirement or to buy a house, an RRSP might be a good option, since it allows you to benefit from tax advantages and the Home Buyers’ Plan. On the other hand, if your goal is to travel or renovate your home, a TFSA might be a better option, since it shelters your investment’s growth from taxation.

However, since your situation is unique, don’t hesitate to meet with a Laurentian Bank advisor to find the best solution for you.

+ Discover the characteristics of RRSPs and TFSAs

Saving solutions

Thanks to our range of solutions, our advisors can establish a personalized investment strategy adapted to your goals, situation, and aspirations. Discover our main solutions.

INVESTMENT

GIC, ActionGICs, mutual funds

GIC

Guaranteed Investment Certificates3 (GICs) are investments that protect the initial capital invested and offer a guaranteed return that is predetermined from the start.

ActionGICs

ActionGICs4 let you take advantage of stock market performance and greater growth potential than a conventional GIC in addition to a 100% guarantee on the initial capital investment.

Mutual funds

A mutual fund2 is a group of investments—stocks, bonds, or other securities—that is managed by a professional portfolio manager. When you invest in a mutual fund, you pool your money with other investors. Your capital is not guaranteed, but there may be a higher return potential depending on market fluctuations.

Did you know that it’s possible to invest according to your values by using an ESG fund?

An ESG fund is an ethical fund that lets you invest responsibly, since it integrates certain environmental, social, and governance criteria into its investment decisions.

An ESG fund brings together companies that work in, among other things, green and renewable energies, or that encourage healthy working conditions and/or the presence of women on boards of directors.

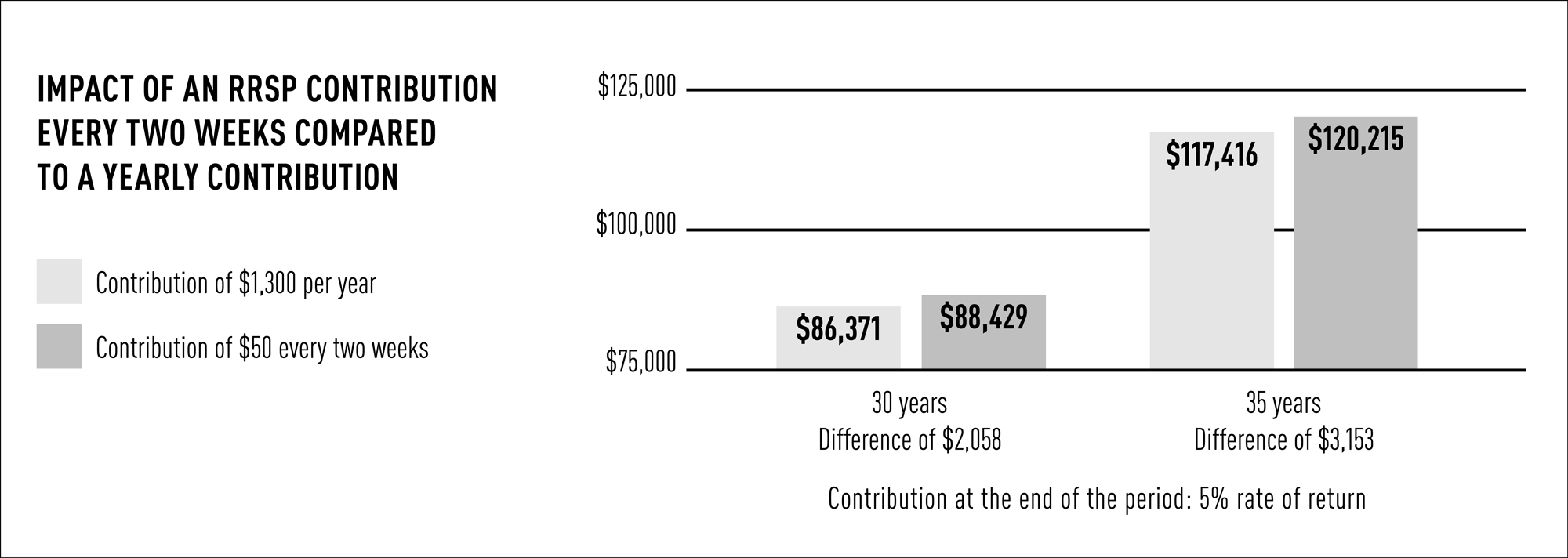

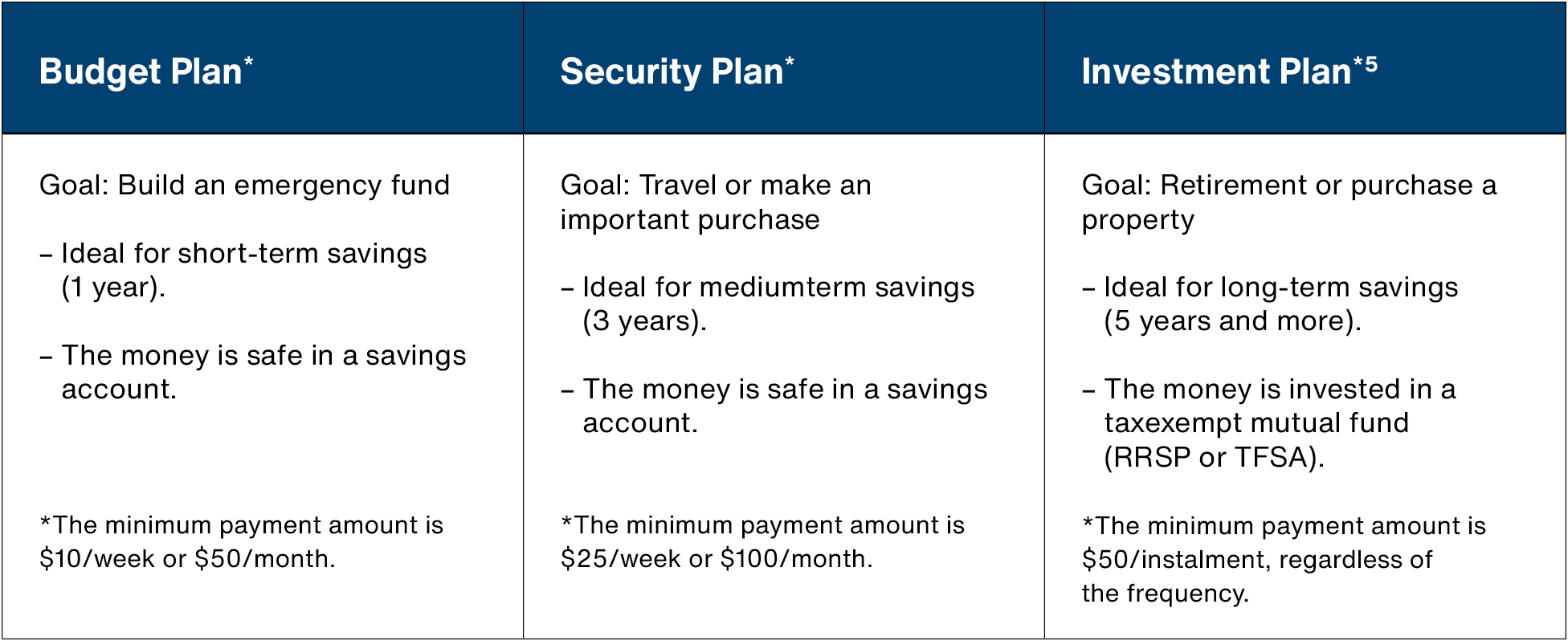

THE PERIODIC SAVINGS AND INVESTMENT PLAN (PSIP)

Saving regularly pays

Saving small amounts throughout the year yields more than making an occasional large investment.

With a Periodic Savings and Investment Plan (PSIP), you choose an amount to be deducted automatically from your account and the frequency of these deductions. Then you can sit back and never have to think about it again!

Automated PSIP deductions let you save all year long, at your own pace, to help you reach your savings objectives and achieve the goals you care about most.

Fictional example provided solely for information purposes, based on an investment in mutual funds.

+ Discover our plans

Three options to fulfill all your needs

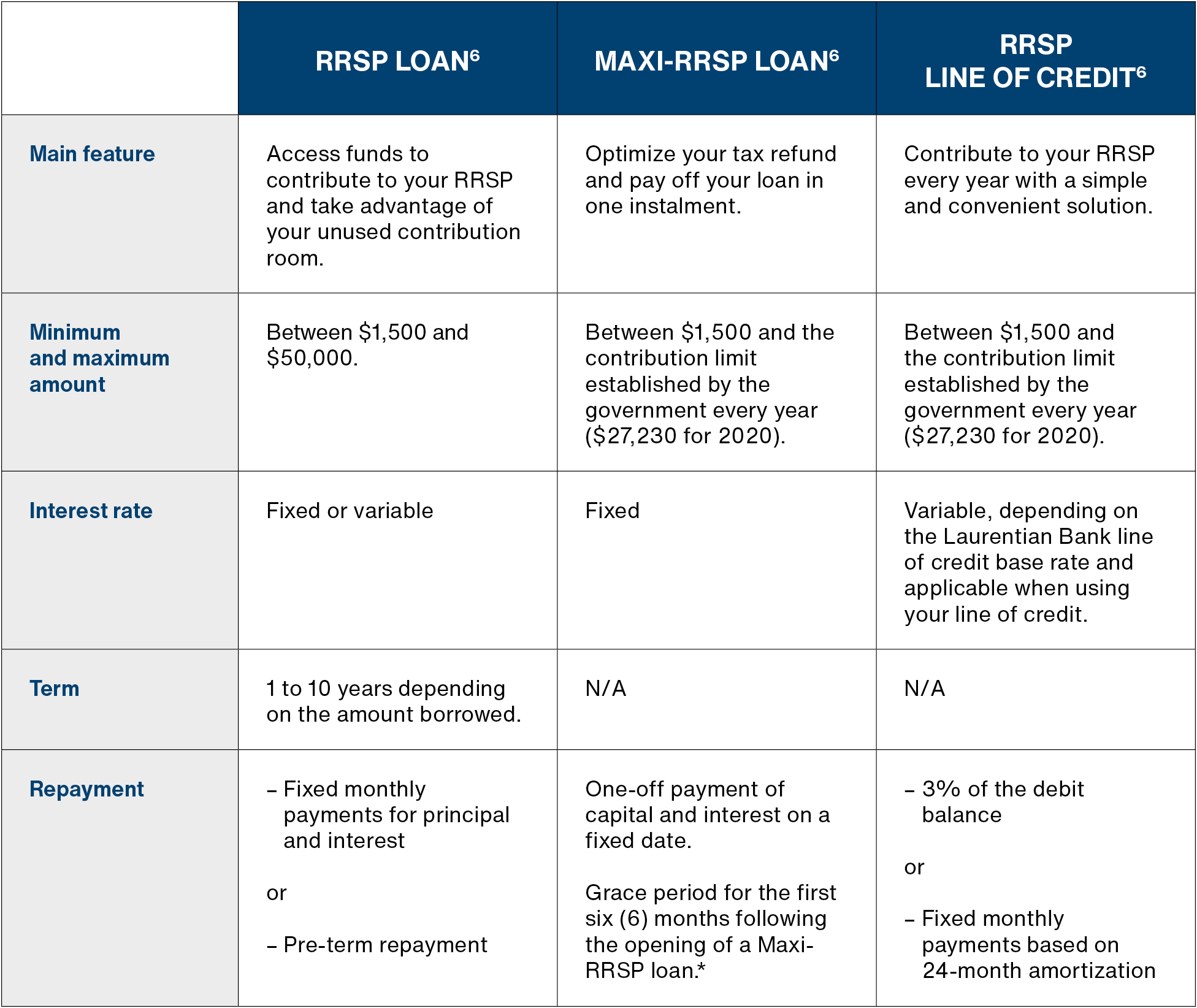

RRSP FINANCING

RRSP loan, Maxi-RRSP loan, RRSP line of credit

Borrowing funds to invest can be a great option to help you save better.

You can use these funds to contribute to your RRSP or to make up your unused contribution room.

Discover the benefits of using RRSP financing to reach your retirement savings goal faster.

Benefits:

- Boost your RRSP contributions

- Enjoy tax-free investment income, generally up until the time of withdrawal

- Reduce the amount of payable tax

- Take advantage of your unused contribution room

- Reach your goal faster

- Benefit from an advantageous interest rate

+ Compare our RRSP financing solutions

Tips

Take stock of your finances

This is the starting point for good financial health.

Here are some tips to help you get there. We suggest you complete this exercise before meeting with an advisor.

+ Discover the tips

- Create or update your budget to figure out where your money is going. That way, you will be able to control your expenses to start saving better. Use a budget table to simplify your life.

- Make a list of your assets (property, belongings, bank accounts, investments, etc.) and liabilities (loan, mortgage, line of credit, etc.). An advisor will calculate your net worth (your assets minus your debts) and make recommendations accordingly.

- Gather your documents (income tax return, federal notice of assessment, statements of your assets and debts, powers of attorney, insurance contracts, statement of participation in the QQP, etc.). Your advisor will let you know which documents to bring.

- Think about your objectives (the reasons you want to meet with an advisor) and the timeframe for achieving them.

- Complete or review your financial health assessment with an advisor. This exclusive Laurentian Bank tool will give you a detailed report of your financial needs.

Taking stock of your finances is easier than you think.

If you need help updating your budget or calculating your assets and debts, our advisory team is here to help you.

Know your investor profile

Understanding your financial situation and habits will help you invest better.

Knowing your investor profile will allow you to determine your risk tolerance and find the asset and investment mix that works best for you.

+ Factors to consider

- Your personal goals

- Your investment horizon

- Your personal situation

- Your financial situation

- Your risk tolerance level

- Your age

Your investor profile may change over time depending on the factors above. We recommend that you review your investor profile annually or when one or more of these factors are subject to change.

Diversify your investments

Three reasons why you should diversify your portfolio:

- It’s not optimal to get a return on your different investments at the same time.

- Economic conditions may vary (interest rates, exchange rates, inflation rates).

- Not all investments have the same level of risk.

+ Learn more

The goal of diversifying is to spread out the risk, choosing different investments to protect your savings against market fluctuations without sacrificing potential returns. If certain investments don’t generate the expected return, other investments can compensate, allowing you to balance out your losses and gains.

The keys to a diversified portfolio:

- Invest in several asset categories: cash, fixed income securities, equities. Choose the allocation that best fits your investor profile.

- Put your money in investments with different risk levels: low, medium, high, etc.

- Diversify your investments geographically: Canadian, American and international, to benefit from the strengths of different markets.

Calculators

Some articles to read

Useful links

Make an appointment with an advisor

Legal notice

Home Buyer’s Plan

Registered Retirement Savings Plan

Lifelong Learning Plan

Tax-Free Savings Account

Existing investment accounts are offered by Laurentian Bank of Canada (“Laurentian Bank”) or LBC Financial Services Inc. (“LBCFS”). Mutual funds are distributed by LBCFS. LBCFS is a wholly-owned subsidiary of Laurentian Bank and a separate legal entity from Laurentian Bank, B2B Trustco and all other issuers or mutual fund companies whose products it distributes. Newly opened investment accounts must be LBCFS accounts. A Laurentian Bank advisor is also a licensed LBCFS mutual fund representative. LBCFS’s liability is limited to the conduct of its representatives in the performance of their duties for LBCFS.

- RRSP: You can withdraw from your RRSP at any time. However, the amount withdrawn will be added to taxable income, and withholding tax will be made upon withdrawal. Amounts invested in an RRSP can be deducted, up to the annual allowable limit. Investment earnings in an RRSP are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to an RRSP until the end of the year in which you reach the age of 71; it must then be converted. For more information on your RRSP contribution rights, please consult the Canada Revenue Agency.

TFSA: You can make a withdrawal from your TFSA at any time, with no withdrawal tax. Amounts invested in a TFSA are not deductible. Investment earnings in a TFSA are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to a TFSA throughout your lifetime without the need to convert it to another type of account. For more information on your TFSA contribution rights, please consult the Canada Revenue Agency. - Mutual funds are distributed by LBC Financial Services Inc. (“LBCFS”), a wholly-owned subsidiary of Laurentian Bank of Canada (“Laurentian Bank”). LBCFS is a legal entity distinct from Laurentian Bank, B2B Trustco, Mackenzie Financial Corporation (Mackenzie Investments), and from all other issuer or mutual fund companies whose products it distributes. Each licensed LBCFS representative is also a Laurentian Bank of Canada employee. The liability of LBCFS is limited to the conduct of its representatives in the performance of their duties for LBCFS. Important information is contained in the relevant fund facts. We ask that you read this (these) document(s) carefully prior to investing. For more information with regards to the funds traded, please refer to the funds simplified prospectus. To obtain your copy of the fund facts and/or simplified prospectus concerning the fund(s) you have chosen, please contact a LBCFS representative at the Bank branch. Investing in a mutual fund (“fund”) may result in sales and trailing commissions, management fees, administration fees and other fees. The funds available through LBCFS are not insured by the Canada Deposit Insurance Corporation, Canadian securities regulators, or any other public deposit insurer. In addition, mutual funds are not guaranteed in whole or in part by Laurentian Bank, B2B Trustco, or any other entity. There is no guarantee that a fund will maintain a constant value per unit, or that you will recover the full amount invested in a fund. Funds often fluctuate in value, and past performance is not an indicator of future performance.

- Some conditions apply. GICs are not cashable. Simple interest is paid on terms of less than two years. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible for this offer. This product is eligible for registered and non-registered plans. This product is eligible for deposit insurance from the Canadian Deposit Insurance Corporation (CDIC) up to the maximum limit for coverage from the CDIC and subject to applicable conditions. This offer cannot be combined with any other offer. Additional information can be obtained by calling 1-844-494-0076, or by contacting your advisor.

- Some conditions apply. This offer may be modified, suspended or withdrawn at any time without notice. The posted rate corresponds to the maximum rate of return. The Blue Chip ActionGIC 5-year term maximum rate of 22% is equivalent to an annual compounded maximum rate of return of 4.057%. Simple interest paid at maturity. Return is not guaranteed and may be nil at maturity. The final rate of return of a Laurentian Bank Blue Chip ActionGIC is calculated based on the performance of the reference index between the issue date and the maturity date of the investment. The value at maturity is obtained by calculating the average value of the index at closing, on the three dates for the calculation of the reference index as specified in the purchase agreement. The final return of the reference index is determined by calculating the sum of the return for each share in the reference index during the period divided by the number of shares making up the reference index. Since the rate of return of this investment depends on the performance of a reference index comprised of securities, any fluctuations in the reference index will affect the investment’s final rate of return. Past performance is not an indicator of future performance. If the total return obtained is negative or nil, the invested capital is fully guaranteed and will be remitted upon the investment’s maturity, but no interest will be paid out. If the total return obtained is positive, the invested capital and interest (up to the maximum rate of return set on the issue date) will be paid out upon the investment’s maturity, since the return will be known only at that time. This investment is eligible for a non-registered or a registered plan such as an RRSP, RRIF or TFSA. A minimum investment of $500 is required. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank of Canada investment product are not eligible for this offer. For more information, including offer terms and conditions, are available in a Quebec branch or on the Blue Chip ActionGIC page of our website.

- Some conditions apply. This offer may be modified, suspended or withdrawn at any time without notice. GICs are not cashable. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. This product is eligible for registered and non-registered plans. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank of Canada investment product are not eligible for this offer. For more information, including offer terms and conditions, are available in a Quebec branch or on the Guaranteed Investment Certificates page of our website.

- Some conditions apply. This offer may be modified, suspended or withdrawn at any time without notice. This offer is only eligible for new TFSA and RRSP contributions, as well as for transfers of funds from other financial institutions to TFSA or RRSP plans at Laurentian Bank of Canada. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank of Canada investment product are not eligible for this offer. Cashable without penalty after 30 days. Simple interest is calculated and paid at maturity. For more information, including offer terms and conditions, are available in a Quebec branch or on the Term Deposit page of our website.

Legal notice

Laurentian Bank of Canada

Tax-Free Savings Account

Guaranteed Investment Certificates

Term Deposit

Lifelong Learning Plan

Home Buyer’s Plan

Registered Retirement Savings Plan

The content of this website is for information purposes only and must not be interpreted, considered or used as if it were financial, legal, fiscal or other advice. It does not create any legal or contractual obligation for LBCFS, Laurentian Bank or their affiliates. They cannot be held liable for any damages or losses that may arise from any errors or omissions in its content or from any actions or decisions taken in reliance on such content.

Existing investment accounts are offered by Laurentian Bank or LBCFS. LBCFS is a wholly-owned subsidiary of Laurentian Bank and a separate legal entity from Laurentian Bank, B2B Trustco and all other issuers or mutual fund companies whose products it distributes. Newly opened investment accounts must be LBCFS accounts. A Laurentian Bank advisor is also a licensed LBCFS mutual fund representative. LBCFS’s liability is limited to the conduct of its representatives in the performance of their duties for LBCFS.

- RRSP: You can withdraw from your RRSP at any time. However, the amount withdrawn will be added to taxable income, and withholding tax will be made upon withdrawal. Amounts invested in an RRSP can be deducted, up to the annual allowable limit. Investment earnings in an RRSP are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to an RRSP until the end of the year in which you reach the age of 71; it must then be converted. For more information on RRSP and your RRSP contribution rights, please consult the Canada Revenue Agency.

TFSA: You can make a withdrawal from your TFSA at any time, with no withdrawal tax. Amounts invested in a TFSA are not deductible. Investment earnings in a TFSA are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to a TFSA throughout your lifetime without the need to convert it to another type of account. For more information on TFSA and your TFSA contribution rights, please consult the Canada Revenue Agency. - Mutual funds “funds” are distributed by LBCFS, a wholly-owned subsidiary of Laurentian Bank. Important information is contained in the relevant fund facts. For more information with regards to the funds traded, please refer to the funds simplified prospectus. Please read this (these) document(s) carefully and consult your advisor prior to investing. To obtain your copy of the fund facts and/or simplified prospectus concerning the fund(s) you have chosen, please contact a LBCFS representative at the Laurentian Bank branch. Investing in a fund may result in sales and trailing commissions, management fees, administration fees and other fees. The funds available through LBCFS are not insured by the Canada Deposit Insurance Corporation, Canadian securities regulators, or any other public deposit insurer. In addition, mutual funds are not guaranteed in whole or in part by Laurentian Bank, B2B Trustco, or any other entity. There is no guarantee that a fund will maintain a constant value per unit, or that you will recover the full amount invested in a fund. Funds often fluctuate in value, and past performance is not an indicator of future performance.

- Some conditions apply. GICs are not cashable. Simple interest is paid on terms of less than two years. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible for this offer. This product is eligible for registered and non-registered plans. This product is eligible for deposit insurance from the Canadian Deposit Insurance Corporation (CDIC) up to the maximum limit for coverage from the CDIC and subject to applicable conditions. This offer cannot be combined with any other offer. Additional information can be obtained by calling 1-844-494-0076, or by contacting your advisor.

- Some conditions apply. The final rate of return of a Laurentian Bank Blue Chip ActionGIC is calculated based on the performance of the reference index between the issue date and the maturity date of the investment. The value at maturity is obtained by calculating the average value of the index at closing, on the three dates for the calculation of the reference index as specified in the purchase agreement. The final return of the reference index is determined by calculating the sum of the return for each share in the reference index during the period divided by the number of shares making up the reference index. Since the rate of return of this investment depends on the performance of a reference index comprised of securities, any fluctuations in the reference index will affect the investment’s final rate of return. Past performance is not an indicator of future performance. If the total return obtained is negative or nil, the invested capital is fully guaranteed and will be remitted upon the investment’s maturity, but no interest will be paid out. If the total return obtained is positive, the invested capital and interest (up to the maximum rate of return set on the issue date) will be paid out upon the investment’s maturity, since the return will be known only at that time. This investment is eligible for a non-registered or a registered plan such as an RRSP, RRIF or TFSA. A minimum investment of $500 is required. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible. For more information are available in a Quebec branch or on the Blue Chip ActionGIC page of our website.

- Some conditions apply. This offer may be modified, suspended or withdrawn at any time without notice. GICs are not cashable. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. This product is eligible for registered and non-registered plans. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible for this offer. For more information, including offer terms and conditions, are available in a Quebec branch or on the Guaranteed Investment Certificates page of our website.