Save on taxes

Registered Retirement Savings Plan (RRSP)

The best tool for maximizing your personal savings is, without a doubt, the famous RRSP. It has plenty of advantages, especially when it comes to taxes.

- Complete deduction of RRSP contributions up to the maximum allowed

- Possibility of including a wide range of financial products from the bank:

- Tax-free accumulation of interest, dividends and capital gains

- Possibility of converting it into a Registered Retirement Income Fund (RRIF)

- Possibility of splitting your income at retirement through your spouse’s RRSP to pay less taxes

The trick, of course, is to start contributing young because trying to catch up later in life is just no fun. Use our secure contribution application form to quickly send your RRSP term investment product application.

Saving and Investment Strategies

- Take advantage of your unused RRSP contributions

- Contribute to your RRSP early

- Contribute to your RRSP regularly

- Contribute the maximum to your RRSP

- Invest in your spouse's RRSP

- Diversify your portfolio

- Consolidate your investments

- Beware of formulas for instant success

- Ask an expert for advice

Take Advantage of Your Unused RRSP Contributions

Borrowing money to contribute? As crazy as this strategy may seem, it may be the key to contributing the maximum to your RRSP. It can be very lucrative in the long run. Here’s how:

- The compound growth of your investment is greater than the short-term interest;

- You'll enjoy an optimal tax reduction;

- The amount added to your repayment lets you decrease your loan.

Pretty clever, don't you think?

Borrowing to Make the Most of Unused RRSPs

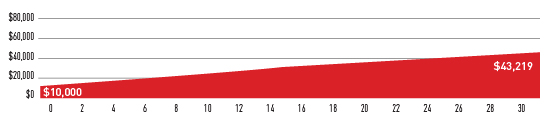

The following example demonstrates the extent to which it can ultimately cost very little to benefit from your unused RRSPs. If you then use your tax refund to pay off your loan faster, your investment could be very economical too.

| Basic Information | |

|---|---|

| Amount of unused RRSPs | $10,000 |

| Taxable income | $60,000 |

| Tax refund1 | $3,712 |

| Financing Information | |

|---|---|

|

RRSP financing |

$10,000 |

|

Financing term |

7 years |

|

Financing rate |

7.250% |

When you apply your tax refund to your loan, your payments will be $94.967

If you invest $10,000 in unused RRSPs, in 30 years you will have saved $43,2192 and these savings will have only cost you $8,3333.

In this example, for a taxable income4 of $60,000, a $10,000 RRSP loan would have cost only $8,3333!

Learn more about RRSP financing

Contribute to Your RRSP Early

It really is as easy as that. If you start contributing early, you have years of potential growth ahead of you, which can really pay off in the end!

The example in the following table couldn’t be clearer. By contributing early, not only can you accumulate more money down the road but you also do so by investing a lot less.

| Ms. Early | Mr. Late | ||

|

Age of first contribution |

25 |

35 |

|

|

Number of years contributing |

15 |

30 |

|

|

Annual contribution |

$3,000 |

$3,000 |

|

|

Total contribution |

$45,000 |

$90,000 |

|

|

Return |

6% |

6% |

|

|

Amount accumulated at age 65 |

$317,6745 | $251,4055 | |

|

Difference |

$66,2696 + $45,000 = $111,269 | ||

Mr. Late contributes $45,000 more and finishes with $66,2696 less than Ms. Early.

Contribute to Your RRSP Regularly

Contributing every week or month makes it easier for you to manage your budget and see things clearly. Plus, it's the best way to build a nest egg without even noticing, especially with automatic withdrawals!

Our Periodic Savings and Investment Plan lets you contribute to your RRSP account at your own pace and we take care of the rest. You can even change the frequency whenever you want. To contribute the maximum, there's no better way!

Periodic Contribution Value Calculator

Contribute the Maximum to Your RRSP

You can contribute up to 18% of your previous year's income to your RRSP, for a maximum of $27,830 in 2021. By squeezing every last drop out of your contributions, you reduce your tax bill to its minimum and your savings grow faster thanks to compound interest. It is as economical as it is lucrative!

Otherwise, you can always carry over your unused RRSP contributions to the following year or several years later, up to age 71, but you will never recoup the lost growth.

In some cases, especially if you contribute to a pension fund at work, you might have to factor past pension or service adjustments into your contribution amounts. For more details, refer to your notice of assessment from the Canada Revenue Agency (CRA).

Invest in Your Spouse's RRSP

If you earn more than your spouse, there are two advantages to contributing to his or her RRSP.

- You take advantage of the tax deduction right away

- By splitting your income at retirement, you pay less tax

| Situation WITHOUT Contribution to Your Spouse's RRSP | |||

|---|---|---|---|

|

|

You | Your Spouse | Total |

|

Taxable income at retirement |

$60,000 |

$0 |

$60,000 |

|

Taxes to be paid* |

$13,676 |

$0 |

$13,676 |

| Situation WITH Contribution to Your Spouse's RRSP | |||

|---|---|---|---|

|

|

You | Your Spouse | Total |

|

Taxable income at retirement |

$30,000 |

$30,000 |

$60,000 |

|

Taxes to be paid* |

$4,169 |

$4,169 |

$8,338 |

|

Tax savings |

|

|

$5,338 |

*Tax rates based on the 2020 tax table. Basic personal credit of $13,808 (federal), provincial allowance of 16.5% from basic federal tax, basic personal credit of $15,728 (provincial).

Diversify Your Portfolio

Diversification is one of the keys to long-term growth. Why? Because it protects you from market fluctuations. Every type of investment can't do poorly at the same time!

Most of the return on your investments is tied to the allocation of assets within your portfolio, so you'll have a higher potential return if you have a portfolio with a wide range of investments.

Consolidate Your Investments

"Diversified" doesn’t necessarily mean "spread out." If you have several plans and are fed up with managing them, it might be a good time to consolidate them. You can consolidate your investments at one institution without making them less diversified or throwing off the balance of your portfolio. The advantage? All your affairs on one statement.

Beware of Formulas for Instant Success

Don’t forget that in finance, there is no formula for instant success. If it seems too good to be true, get the facts before you jump on board because you just might be boarding a sinking ship.

A good advisor will always remind you that risks are inherent to investing, so it's up to you to decide how much risk you'll willing to take on.

Investing According to Market Trends

It's not necessarily the best time to buy when the stock market is on an upswing. It might be tempting, but take heed. Remember that it's better to build your portfolio according to your investor profile and your long-term goals.

Investing in Last Year's Top Securities

Past returns are never indicative of what’s to come. Yes, they might continue to boom but they could just as easily go bust—big time!

Investing in a "Sure Thing"

"Sure things" don't exist. Too many people are duped every year, so be vigilant! When in doubt, walk away and forget about all those "incredible offers" you hear about by phone or on the Internet.

- Demand contact information

- Run a security check, if necessary

- Never give out personal information before running a check

Ask an Expert for Advice

Don't hesitate to call upon our advisors' expertise. Call them, meet with them, and ask them questions! Your retirement plan is guaranteed to meet your expectations and goals. Financial markets being what they are—unpredictable—you should also consider revising your plan once a year with your advisor. It's a wise move and will keep you on track.

Legal notice

1. Approximate calculation based on the exemption for a single person without dependents according to federal and provincial tax tables for the province of Quebec in 2021.

2. Calculated based on an annual compound interest rate of 5%.

3. The amount of $8,333 represents the cost of borrowing (capital and interest) for this example.

4. Approximate calculation based on the exemption for a single person without dependents according to federal and provincial tax tables for the province of Quebec in 2021.

5. Contribution made at the start of the period.

6. The difference between the amounts accumulated at age 65 ($317,674 – $251,405 = $66,269).

7. Based on a taxable income of $60,000.